5 Easy Ways to Be Financially Stable

- Jeremy Miller

- May 17, 2021

- 5 min read

Updated: Aug 29, 2021

Who would ever take financial advice from a 23 year old? I’m not sure… but I’m gonna give you my advice anyways.

If you’re truly curious and want to get better, then you should seek advice from anyone and everyone. Every single person on earth has a life experience unique to them, so maybe they have discovered something you haven’t.

While I wouldn't say that I'm rich, I will say that my finances are somewhat in order. I have no consumer debt, I have money in savings accounts, and I have three different investment accounts:

Who would ever take financial advice from a 23-year-old? I’m not sure… but I’m gonna give you my advice anyways.

If you’re truly knowledge-seeking, then you should seek advice from anyone and everyone. Every single person on earth has a life experience unique to them, and just maybe they have discovered something you haven’t.

While I definitely wouldn't say that I'm rich when it comes to money, I will proudly say that my finances are somewhat in order. I have no consumer debt, I have emergency savings accounts, and I have three different investment accounts.

The only debt I have is a small business loan and a small amount of student loans. The only monthly payments I have are my rent and some subscriptions (Netflix, Spotify, Zwift, etc.). No car loans, no mortgage, no credit cards.

My goal is to be totally debt-free within the next twelve months and to have enough money in my investment accounts to ‘retire’ by the time I’m 35 years old. By retire, I don’t mean sitting on a beach in Florida drinking margaritas all day. Rather, I mean not having to worry about money. Being financially free and being able to work on things I truly care about without the worry of ‘needing to make money’.

There’s a popular talk that discusses the idea that work is better when you don’t need the money. That’s what I’m trying to achieve.

Remember: money isn’t everything in life, but it’s certainly an important part. Money gives us the freedom to escape the 9-5 rat race and enjoy the real things in life.

These are my five tips that I am actively using to build my wealth. These things are proven to work and you can use them too. Lastly, these are not organized in any particular order; they are all equally important to financial success.

1. Keep a Budget

Keeping a budget is one of the easiest, yet one of the most significant things you can do when it comes to finances. You should know exactly where every single dollar is going every month. You should know exactly how much money you have incoming and outgoing. Not only does this help you to plan and organize your finances, but updating a budget sheet every week forces you to always be thinking about it. You can download a digital budget sheet here.

2. Invest as Much as You Can

As Ben Franklin once said, "Money makes money. And the money that money makes, makes money." What a guy. Did you know if you invest $100 each month into an ordinary mutual fund for 40 years, you’ll be a millionaire? Compound interest at its finest. I know that investing scares a lot of people; it’s not something that is required to teach in school and your parents likely didn’t teach you about it, either. When you start to learn about the stock market and investing, you’ll quickly realize it’s just a bunch of sophisticated-sounding lingo that describes very simple concepts. Don’t be intimidated by it. I didn’t know anything about investing two years ago, now I have multiple investment accounts. You can do it too, it just takes some time to learn it. I currently invest 30% of my monthly income--which I realize is a lot for most people--but I make sacrifices in other areas in order to do so. I only eat out a couple times a month and I don’t drink. Those are both huge expenses for most people. Why is it so easy to spend $25 on a single dinner every week, but putting $100 into an investment account every month is so difficult? If you ask any older person if they wish they would’ve started investing sooner, 00% of them would say, "hell yes!" I can’t express enough how important it is to invest your money. My personal investment accounts are as follows:

- One solely for retirement and long-term investments (mutual funds through Fidelity)

- One for riskier and short-term investments (individual stocks and ETF’s through Robinhood)

- One for good ol' Bitcoin and cryptocurrency through Binance.

3. Avoid Consumer Debt

Consumer debt is the thief of wealth. Just as compound interest can work in your favor, it can also work against you. There's actually a very simple way to avoid consumer debt: don’t spend money you don’t have. If you have a credit card, only use it for gas. Only put a small amount on it at a time. That way, you know you can pay it off at the end of every month and you're still building credit. Do not let your credit card carry a balance from month to month. That 20% APR will cause a world of hurt to you and your finances very quickly. If you currently have any kind of consumer debt, work on paying it all off before you start investing. Don’t just make the minimum monthly payments, pay off as much as you can as quickly as you can. If you can eliminate your $500 monthly car payment, that $500 that is now freed up to put into an investment account.

4. Have an Emergency Savings Account

Every financial guru I’ve listened to recommends having anywhere between 4-12 months of expenses socked away in a high-yield savings account. Your car is going to have mechanical issues. The economy is going to go into a recession and you’ll get laid off and be out of work for a few months. Your refrigerator is going to stop working and you have to go buy one immediately. Life happens and unexpected events are inevitable, but that doesn’t mean you have to be caught off-guard. By keeping an emergency fund, you can be prepared for when these things happen and you won't have to ruin your finances. Don’t use this emergency fund to buy a brand-new car. Don’t use it to buy Christmas presents. Use it only for emergencies and unexpected costs.

5. Be a Sponge

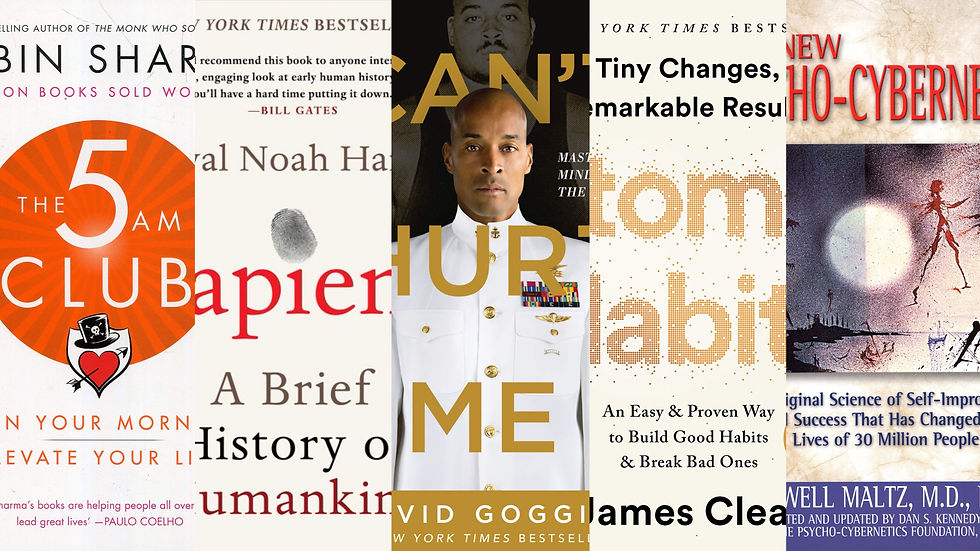

Last but certainly not least, let your mind be a sponge when it comes to finances. Read every personal finance and investment book you can get your hands on. There are thousands of YouTube videos discussing personal finance and investing. There are tons of podcasts, radio shows, magazines and newsletters that can keep you up-to-date on the latest financial news. Listen to a podcast or audiobook on your way to work or while you’re working out. Read just a few pages of a book every day or spend 10 minutes watching a YouTube video. There are literally zero excuses to not understanding personal finance and investing. You can never know too much about personal finance and taking the time to learn about it will be one of your best investments.

Comments